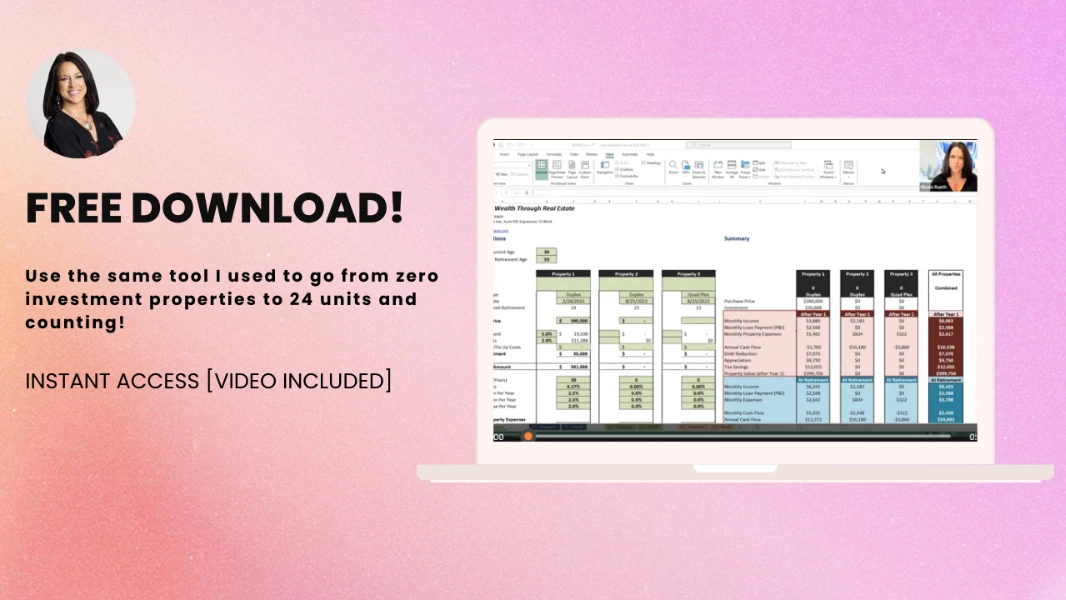

Get My Personal Rental Income Planning Tool!

“We changed the financial trajectory of our family forever by buying investment properties.

I am on a mission to help as many women and families do the exact same thing. I will teach you my strategy, show you how to analyze a property and help you get the proper financing.”

-Nicole Rueth

Our Industry Professionals

The most important asset to our company, is our people. Our team was built with you as our focus.

Start a discussion about your mortgage needs today!

We pride ourselves on excellent communication and easy accessibility when you need us. Our experienced staff is here to guide you every step of the way.

Speak to a Local Professional

Free consultation – No obligation

Personalized guidance

Clarification and education

"*" indicates required fields

Market Trends and Lending Solutions

Our clients are the foundation of our success.

300+ Client Reviews

Client reviews from around the internet.