They Don't Know The Fannie Mae Home Purchase Sentiment Index® (HPSI) released this week jumped…

Rates Are Getting More Volatile

Rates are Getting More Volatile

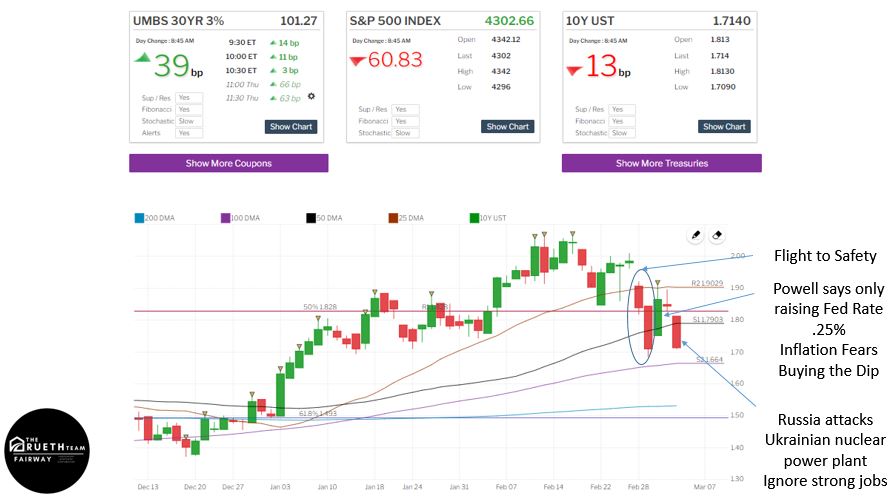

As the Fed finished it’s quantitative easing, we are immediately seeing the impact on the market interest rates, as rates are getting more volatile, as well as world events play out on the bond market. The Fed’s next meeting is March 15-16; where Powell will announce the anticipated .25% Fed rate hike and possibly their intentions on quantitative tightening (QT). Don’t hold your breath on hearing more than speculation on quantitative tightening at the March meeting though as Powell just wants to come out of this meeting with his pants still on. QT will mean rates will go higher as the Fed runs off their balance sheet putting more supply into the market, satisfying demand and lowering bond prices, which in turn raises the 10-year treasury and the 30-year mortgage rates. Higher rate in the face of higher inflation burdened by limited supply will push us into Stagflation.. not the goal.

Let’s see what happened in the first four days of this new month without quantitative easing…

Monday and Tuesday saw an extreme drop in the 10-year treasury as Russia stepped up it’s attacks and investors pulled their money out of riskier options to the safety of bonds. We also saw money move as Russia had a run on their banks and Ukrainians needed to protect what was theirs. This move saw a drop from where we were headed to 2% again to 1.68%. That’s big. It created an opportunity for pipeline loans to get locked and a media blitz on rates retreating due to the war.

But stockholders didn’t want to let all goodness go to waste.. Robinhood buyers saw the opportunity to buy on the dip and jumped in; immediately pushing the stock market back up (see swift jump below) pushing the 10-year treasury back up to 1.92 before it settled at 1.86%. What else affected us on Wednesday was Powell speaking at the House of Representatives. He spoke at the Senate on Thursday with more of the same. Powell said he is personally taking 50 bp increase in the Fed rate off the table due to the unknown impact of Russia on inflation. Taking that off sounds good for a second, until it’s realized that bonds HATE inflation. So dropping the 50 bps to 25 bps, just means we are not using the tools we have to curtail the 7.5% CPI and 5.2% PCE.

Friday morning we wake up to hear the pleas of Volodymyr Zelenskyy, Ukraine President, requesting “urgent action” and heeding a warning to people everywhere, especially Europeans, that Russia’s attack on their largest nuclear power plant, in fact Europe’s largest nuclear power plant, could change everything. As the day progressed it was learned the attack only hit the training center and Russia was allowing Ukraine to continue to operate the plant. But it is still occupied by Russia. All of this caused another run to safety as the 10-year ended the week at 1.73%.

So what does this mean for rates? Inflation will continue to hinder any real or lasting dips in rates. As oil is up 10%, coal up 15%, gas up 20%… and that’s in the United States. Europe is feeling this TIMES 10. Wheat is up 75% in the last 5 days alone. Corn is up 32%. Food will cost more, gas will cost more, goods will cost more. Housing just got global.. more than ever before. Our financial markets impacted by supply, fear, access, financial influx as countries move money, hide money or have less money to spend.

People will need to make choices. What we are seeing right now is the choice for housing, as construction spending continues to increase for residential (22% above 2006-7’s peak). People know the lasting benefit of housing… hedge against inflation, appreciation, cash flow, shelter. They are not making land anymore. What we are spending less on? Cars. Vehicle sales are down 12% year over year, 6% this last month alone.

Listings Moved FAST!

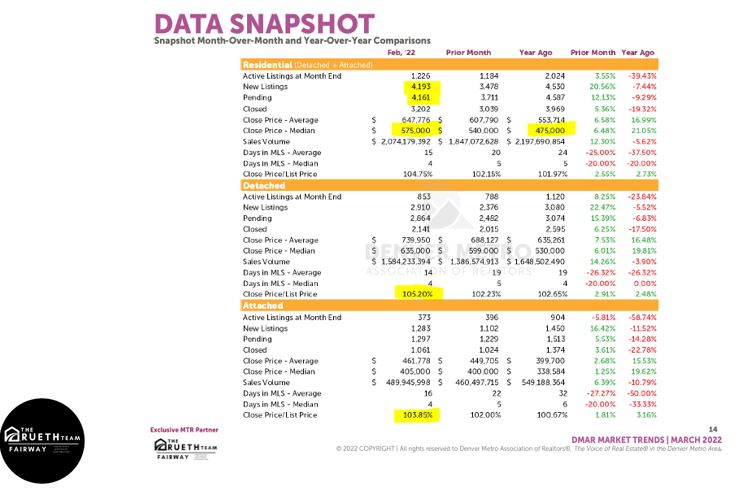

Back to houses.. you felt it in February. Totally simplifying here.. but .. 4,193 homes came on the market. 4,161 homes went under contract. That left 32 homes for sale. Again.. simplifying. But really? This is not an inventory issue. This is a demand issue. Our demand is so strong they are pushing contract prices on average to 104.75% over list. They are moving off the market in 4 days. They know the power of real estate.

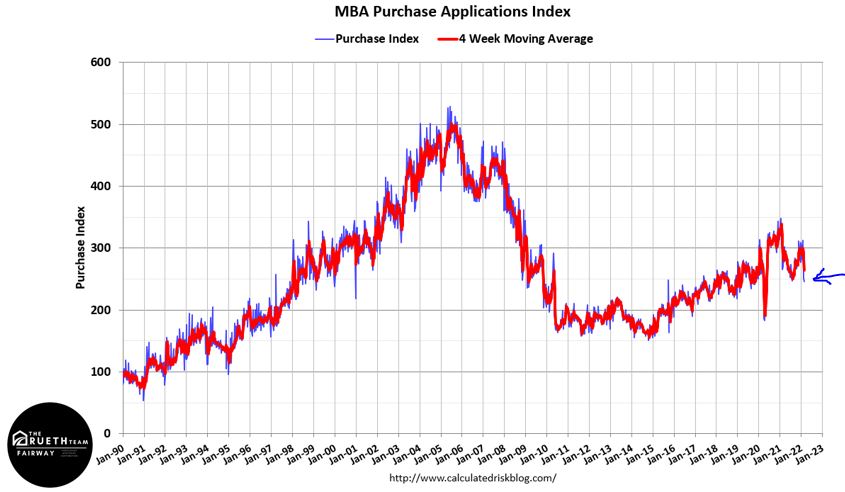

But March could see more inventory and slightly less demand as rates go up. We already saw purchase apps dropped 1.7% week over week and 8.6% year over year the week before last when rates topped 4%. This week’s numbers will be released on Wednesday… so expect a kick up in apps as rates had a 2 day fall. This demonstrates what is true.. high prices will calm high prices. Rising median prices 21.05% year over year per DMAR plus rising interest rates will soften, NOT eliminate demand. A repeat of 2018 when inventory popped up 1,000 units as rates climbed to 5%.

Buyers will have to make choices. There’s been a 10% gain in just the last 6 months while rates went from just below 3% to high 3’s. My team put together three charts to help you help your buyers assess their comfortable budget as well as, the impact waiting has had on their purchasing power. Want all three? They will be hitting social media this week, but I’m giving you early access. Email me and I’ll send you all three charts.. $300k-$600k; $600k-$900k; and $900k-$1.200k TODAY! Watch for their release this week on our Agent Ignite FB Group. Not a member yet? Join now! And you’ll also gain access to all of our video recaps, classes, sharables.

REALTORS… Below are your personal LENDING ADVANTAGES…

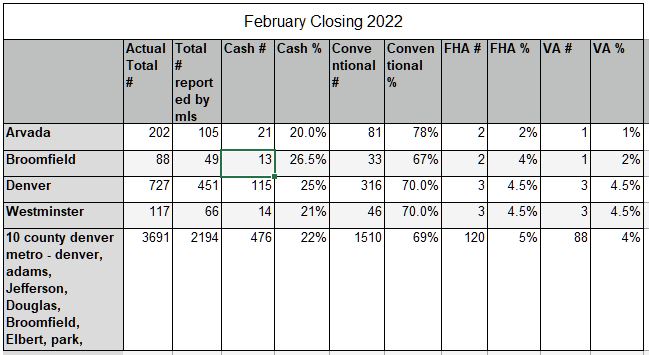

Have you lost a deal to another buyer-lender? Why? What did they have that you didn’t? Don’t say cash… yes, it moved up in February, but only 22% of our sales in the last 30 days were cash. So if 78% of the buyers came in with a loan, could you and I have partnered together to get your clients under contract?

>> HUGE shout out to Nicki Thompson at Re/Max Alliance Olde Town for running this report for me.

*total # reports is those closed loans with data summited by the agent to the MLS.

Some lenders are limited in what they can offer; but as the highest producing Branch Manager at Fairway, I have a red phone on my desk to the top. The Rueth Team wants to be your biggest advocate and your clients biggest fan!

What needs to be added to this list to give your buyers the edge? Let’s do it!

What needs to be added to this list to give your buyers the edge? Let’s do it!

- $1000 to the buyer and seller if we push closing due to the loan

- Lock and go for buyers worried about rates going up.

- 8-10 Day Closings

- Waive Loan Availability

- Waive Appraisal Deadline with an Appraisal Waiver

- Appraisal Gap Insurance

- Waive Inspection Objection … pass/fail

- Protect $15,000 of their EM with our EM Guarantee with our TBD Underwriting

- New build buyers want stability with our extended locks

- Options Options Options… 3.5% down jumbos, 55% DTI jumbos, LLC investment purchases with 15% down

- Cash buy/Bridge Funds

You want the best lender who educates, advises and supports your clients to the closing table! We would love the opportunity to support you and your clients! Call me.. really.. call me. You know I’m working 😉

For more detailed information on the February 2022 Denver Real Estate Market Trends, be sure to check out my most recent update HERE!