Real Estate Investing: Easy Peasy or Strategic Moves?

I’m sitting in a hotel room this morning overlooking what I will call one of the most breathtaking views in the world, New York’s Central Park. Even in it’s shades of winter brown, I will hold this place up against any other. Go ahead, debate me, doesn’t matter. The thousands of owners who line the park touting their increased real estate value due to the view win.

Does their value change with the change in rates, Fed announcements, the stickiness of inflation, or wage spiral? No. A good investment stands the test of time. Whereas, a bad investment can look great when rates are low, the economy is booming and liquidity and spending are high. Low interest rates hide the flaws

I read two articles this morning that got me chewing on this. One on Jeff Bezos’ backed Arrived Homes, a crowd funding real estate investment pool and Grant Cardone’s Cardone Capital, a real estate investment fund. You can join 100,000 other investors and buy shares of a home for as little as $100 with Jeff. Or buy into a larger portfolio of 12,000 multi-families with Grant. Easy peasy.

Easy peasy? Economies of scale, yes. But does it give you options? We were spoiled with big returns in a low-interest rate environment and now we continue hunting for the quick fix. It’s time to get strategic. As the good investments, the real wins, do well in any environment.

I had the extreme pleasure of sitting down with an amazing couple yesterday. He is 67 and she is 62. They have two properties and eight hundred thousand in the bank. This is really incredible given they only moved to the U.S. from Mexico twelve years ago. He is self-employed so while they have saved well, they have little in retirement accounts. So we have to make that $800k go to work for them. Over the course of 90 minutes we built a plan to take them from a high stress job and outlook to one of options. Options of long term appreciation growth, leveraging their funds to grow four times faster using rental income, and designing an exit strategy that would take him out of his daily grind.

Real Estate isn’t about the money; it’s about the options.

And Then February Happened

When it comes to the mortgage and housing markets, there’s been no shortage of gloomy headlines for months. This generally involves slumping sales, lower prices, and higher rates. All of the above are interconnected to some extent. The interconnection can be summed up in a single paragraph:

Home prices surged post-pandemic as demand greatly outpaced supply and low rates increased buying power. High home prices (and rents) then contributed significantly to decades-high inflation numbers. Decades-high inflation is the single biggest reason for the fastest rate spike since the 1980s. Newly high rates made buyers increasingly reluctant to shop for homes and homeowners increasingly reluctant to give up the super low rates obtained over the previous 2 years.

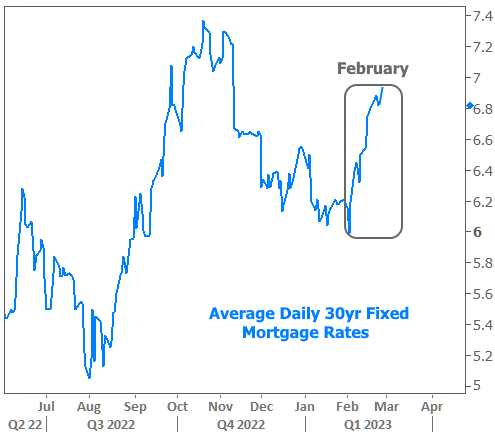

In January, it looked like there might be some reprieve for high rates and slumping sales. But then February happened. A series of strong economic reports caused an immediate renewal of fear over the inflation outlook, and again, inflation is the key input for rates right now.

The most recent addition to the inflation narrative was this week’s PCE Price Index which is frequently referred to as the Federal Reserve’s favorite inflation indicator. PCE doesn’t usually impact markets too much. That honor is reserved for CPI (the Consumer Price Index, which comes out earlier in the month). But if PCE delivers a different message, it can get the market’s attention. That’s what happened this week.

By Thursday, rates were showing signs of calm after several weeks spent surging quickly higher. Then Friday’s PCE inflation numbers came out hotter than expected with the closely-watched “core” number, which excludes more volatile food and energy, rising back to the highest month-over-month levels in decades. This paints a very different picture than the CPI version of the data which had generally been trending lower for more than a year.

Bottom line, the Fed’s “higher for longer” just kicked in and the bond market finally believes it. Doesn’t mean lower rates aren’t coming, they just aren’t coming quickly. But here’s the deal…a good home, a good investment is just that in any interest rate environment. Do the work to ensure you are supporting your clients do their due diligence. Work to make them feel confident to find their perfect first home, their forever home, their first investment with less competition while less confident buyers wait for the lure of lower interest rates.