Job Numbers Shock The Market

A Little Holiday, A Little Savings Making A Big Impact

Jobless Claims, ADP Jobs, NFP Jobs, Unemployment… busy and confusing Friday. Unemployment increased by .1% to 3.7%; mostly due to household jobs numbers going down by 328,000, mostly 45-54 year olds. Yet by the company “birth and death rate” non-farm payroll (NFP) numbers went up by 261,000. There are two outcomes from this info… First, Powell got the go-ahead again to keep raising the fed rate due to job creation. After his 30 minute Q&A section.. not sure he was looking for more reassurance. Second, bonds seemed to understand that jobs were actually lost and improved on the day.

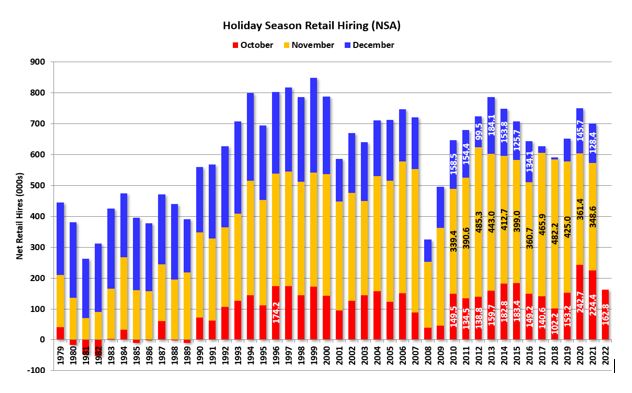

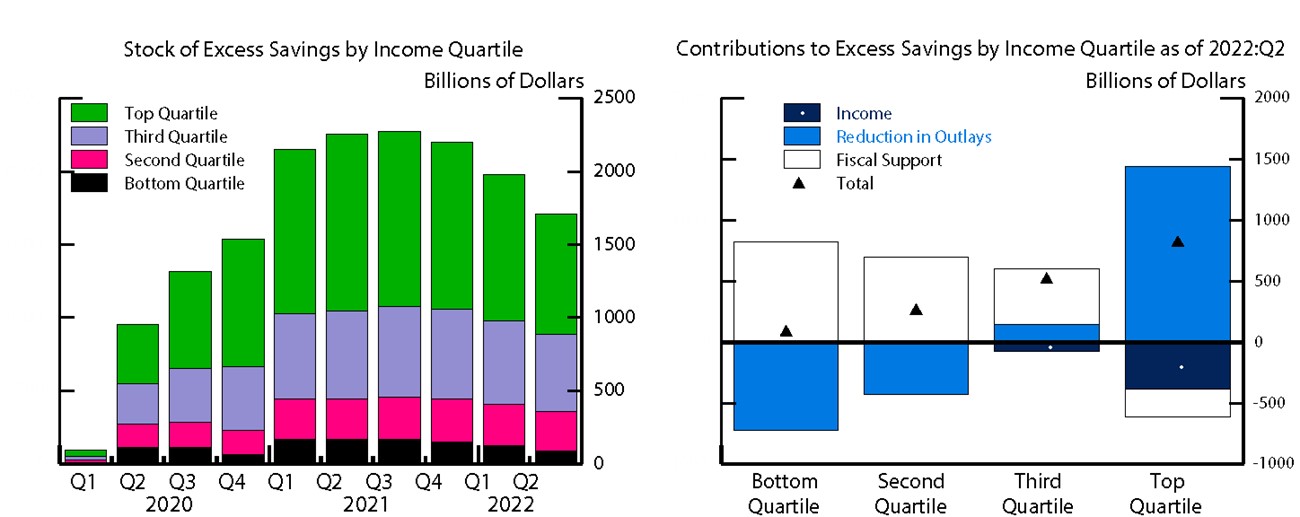

What else kicked in was holiday season hiring. Notice October 2022 is down from the last two years but higher than 2016-2019. (chart 1) Businesses know we are coming off the hottest two years, but still expect Americans to shave off some of that excess cash they are holding onto. Did you miss Thursday’s Market update? We still have $1.7T in excess savings of which $350B is in the hands of lower income households. (chart 2).

Why is this important? News headlines are confusing, especially if you don’t read anything past the actual headline. Buyers are trying to determine what’s important to know and what they should do with that information. Those who already own aren’t in a rush to sell or even buy another property since their budgets are comfy with lower interest rates and fixed payments. If you are a first time homebuyer you might just be fearing your job security or shielding yourself from the embarrassment of buying at the top of the market. But you know who is buying? Investors, growing families, divorced, married, and aging couples. So are buyers who understand real estate is a long game and that trying to catch the market exactly at the bottom will push them into the next demand cycle. Sharing the information that came out this week is a gold mine of opportunistic conversations. Because ultimately real estate is long term and knowing your clients’ goals is key. Not trying to get them to transact; but helping them to build and execute on a strategy.

Renovation or Fix & Flip…Which is better?

As agents you are finding the deals buyers aren’t buying right now. There’s an opportunity for you to capitalize on your craft and make some money through the winter months. And who knows.. maybe when it’s done rates will have dropped??? Or… if not you turn it into a long term rental. Either way you have options and opportunity!

I wanted to give you some of the pros and cons of a renovation loan verses a fix and flip loan. We have both and both are great depending on what you need. As a side note, we also have ADU loans, construction loans, and land loans…it’s all about options!

Let’s start with a renovation loan. In particular, the Fannie Mae HomeStyle loan. We have the FHA 203K and 203KS.. but for this comparison, I am thinking like an investor, not a primary homeowner. Did you know the HomeStyle can be used for a primary home, a second home or an investment? It’s pretty cool!

Highlights of the HomeStyle:

- 1-4 Unit Property (including condos and townhomes)

- Purchase or refinance of a primary, second home or investment with the following LTV limits:

- Primary 95% (97% if borrower qualifies for HomeReady)

- Second home 90%

- Investment property 85% (purchase) or 75% (refinance)

- Duplex 85%

- Triplex or fourplex 75%

- Total loan amount (including all rolled in fees and contingencies) will be limited to conventional loan limits for the area.

- Cannot be a tear down, but can be used to complete any remodel, mechanical, landscaping, and/or add an Auxiliary Dwelling Unit

- Payment reserve of up to 6 months PITIA if borrower must vacate the property during renovation (subject to max allowable LTV). The payment reserve period is only allowed for the timeframe the property is uninhabitable

- Borrower chooses own licensed contractor. Borrower can do DIY work as long as the work is less than 10% of “as completed value”

- Work must be completed within 15 months of closing and can take up to 5 draws

- A contingency reserve will be required up to 15%

- Once work is complete, this is a 30 year fixed Fannie Mae loan which does not need to be refinanced; however, borrower is expected to hold the loan for a minimum of 6 months. It is not intended to be a flip loan.

Given that last bullet, let’s move over to the Fix and Flip loan. This loan’s intention is that you are going to purchase or refinance, fix up the home, then sell immediately. Its use is not long term. Think of it more as hard money.

Highlights of the Fix and Flip Loan:

- 1-4 Unit Property (including condos and townhomes)

- Purchase or refinance of a investment to 90% loan to cost (purchase price + rehab costs) or 70% loan to after repair value

- 12 months reserves required

- Borrower chooses own licensed contractor.

- Work must be completed within 9 months of closing

- Payments are interest only

- Minimum loan amount is $150,000, no stated maximum.

- Borrower is expected to sell property or refinance it into a long-term loan.

- Loan has 3.5 points which can be financed into the loan

- Since this is a portfolio loan there is more flexibility on requirements, qualifying or limits

Again… both are incredible opportunities. A fix and flip is going to be more flexible and allow for higher loan amounts; but costs a little more as it’s intention is a short term loan. The Fannie Mae HomeStyle will be limited to conventional loan limits and need to be held for a minimum of 6 months.

Other then the limits stated above, the only limits are the ones you put on yourself. So.. go big or go home 😉